VAT Calculator Online

Welcome to our VAT Calculator – your go-to tool for swiftly determining the Value Added Tax (VAT) on goods and services. VAT is an indirect tax imposed on businesses, collected from consumers who utilize the products or services. With our user-friendly VAT calculator, you can effortlessly calculate VAT amounts, empowering you to make informed financial decisions. Whether you’re a business owner or a conscientious consumer, our tool simplifies the complex world of VAT.

What is VAT?

Value-added tax (VAT) is a tax on the value of goods and services that a company produces. It is an indirect tax levied on businesses, which means that it is collected by the government from people who consume or use the product or service.

Current VAT Rate in the UK (United Kingdom)

The current standard rate of VAT is 20% and the reduced rate is 5%. Value Added Tax varies from service to service or from product to product. Here is the list.

Reduced Rate Products

Zero-Rated Products

VAT Exempt Products

History of VAT in the UK

The United Kingdom first implemented VAT in 1973. The VAT is collected from VAT-registered businesses by HMRC by registered business. Firstly, you have to register for VAT submission. Standard Rates have changed over time

| Year | VAT-Rate |

|---|---|

| 1973-974 | 10% |

| 1974-1979 | 8% |

| 1979-1991 | 15% |

| 1991-2008 | 17.5% |

| 2008-2009 | 15% |

| 2009-2011 | 17.5% |

| 2011 – present | 20% |

Working Out VAT – VAT Calculator

You can Work Out VAT in 2 ways (Removing / Inclusive / Reversing) or (Adding / Exclusive) VAT.

VAT Calculation Formula

Removing VAT

Adding VAT

Step-1

Enter you amount in the given formula in the (Amount Place)

Step-2

The amount you entered should be according to the formula you choose. If you want to add the VAT amount you have to choose the Add VAT formula and vice versa.

Step-3

Verify your answer with our online calculator.

Examples of VAT Calculation

Price Plus VAT Example

To add the VAT amount just multiply by the exclusive amount by 1.2

To Add 20% VAT

Let’s assume we have VAT exclusive amount and we have to calculate the VAT inclusive these are the following steps to perform

Example

Lets we have a amount of £300

- £300

= £300 * 1.2

= £60 is VAT Amount

= £300+£60

= £360 (Net Amount)

Price Minus VAT Example

VAT inclusive amount means that VAT has already been included in the amount, and the customer pays no more tax. Getting the Value Added Tax amount from the paid amount is not a difficult task. I am going to show the manual way to get this.

To get the VAT part from the VAT inclusive amount you need to divide the VAT inclusive amount by 120 and multiply by 20

To get VAT NET VALUE while knowing VAT inclusive value you need to multiply VAT inclusive price by 100 and then divide the result by 120

Calculate your gst with gst calculator.

Example

Lets we have an amount of £400

- Calculating VAT Part

(400/120)*20=£66.67 - Net Value

(400*100)/120=£333.33

20% is the standard rate of UK since 2011. It includes web services and many more.

The reduced rate for VAT is 5% like domestic fuel and many more.

Education and training, healthcare and medical treatment and many more are VAT Exempt.

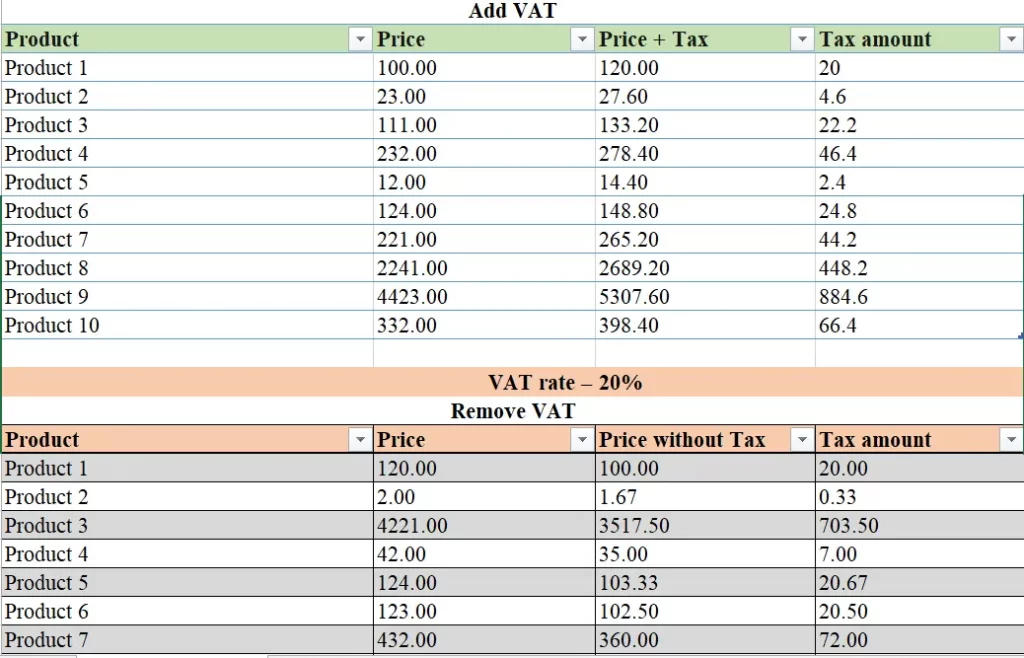

Calculate VAT in Excel

Here is the Excel file to calculate your VAT offline which is fully automatic you just have to put the price of the product.

How to calculate VAT inclusive?

To calculate VAT inclusive, you can use the following formula:

Price inclusive of VAT = Price exclusive of VAT * (1 + VAT rate)

For example, if the price exclusive of VAT is $100 and the VAT rate is 20%, the price inclusive of VAT would be calculated as follows:

Price inclusive of VAT = $100 * (1 + 0.20) = $120

How to calculate VAT exclusive?

To calculate VAT exclusive, you can use the following formula:

Price exclusive of VAT = Price inclusive of VAT / (1 + VAT rate)

For example, if the price inclusive of VAT is $120 and the VAT rate is 20%, the price exclusive of VAT would be calculated as follows:

Price exclusive of VAT = $120 / (1 + 0.20) = $100

VAT Registration and Returns

Businesses with a taxable turnover above the VAT registration threshold must register for VAT. Voluntary registration is also an option, allowing smaller businesses to benefit from VAT reclaims on expenses. Registered businesses must regularly file VAT returns, typically on a quarterly basis, reporting VAT collected on sales and paid on purchases.

Special VAT Schemes

The UK offers special VAT schemes to simplify accounting for smaller businesses. These include the Flat Rate Scheme, Cash Accounting Scheme, and Annual Accounting Scheme. VAT calculator simplified methods for calculating and reporting VAT.

VAT On Import and Exports

VAT on imports and exports plays a critical role in international trade, and understanding how it functions is essential for businesses engaged in cross-border transactions. Here’s a closer look at how VAT applies to imports and exports in the United Kingdom.

VAT on Imports:

When goods are imported into the UK, they are subject to VAT, just like domestically produced goods. The responsibility for paying the VAT on imports typically falls on the importer, who is often registered for VAT in the UK. The VAT is calculated based on the cost of the goods, including customs duties and shipping charges. Importers can usually reclaim the VAT they’ve paid on their VAT return, provided they have valid documentation and comply with HMRC’s requirements.

It’s worth noting that post-Brexit, importers and exporters dealing with the European Union (EU) may face additional VAT complexities. VAT may be payable at the point of entry into the UK, and businesses need to account for VAT when moving goods between the UK and the EU. To facilitate smoother trade, consider VAT deferment and simplification schemes that may be available.

VAT on Exports:

Exported goods and certain services are typically zero-rated for VAT in the UK, provided specific conditions are met. This means that when a UK business sells goods to customers outside the UK, they do not charge VAT on the sale. However, it’s essential to keep records and documentation to demonstrate that the goods have left the UK, confirming their eligibility for zero-rating.

To benefit from zero-rating, businesses must maintain proper documentation, including invoices, shipping records, and evidence of export (e.g., customs declarations). This documentation is crucial to support zero-rating claims and compliance with VAT regulations.

Businesses involved in exports should also be aware of international VAT and customs regulations, as they vary from country to country. Consulting with customs experts or trade advisors can help navigate the complexities of international trade. To calculate the Vat on import and export use our customized VAT calculator.

Penalties and Compliance

Compliance with Value Added Tax (VAT) regulations is crucial for businesses and individuals in the United Kingdom. Non-compliance can lead to penalties, fines, and legal repercussions. This section provides an in-depth look at the importance of VAT compliance and the potential consequences of failing to meet regulatory requirements.

Importance of VAT Compliance:

Compliance with VAT regulations is not just a legal obligation; it’s essential for the financial health and reputation of businesses. Proper compliance ensures that the correct amount of VAT is collected and paid to HM Revenue and Customs (HMRC), preventing potential underpayments or overpayments that can lead to financial complications.

Consequences of Non-Compliance:

- Penalties and Fines: HMRC has the authority to impose penalties and fines on businesses and individuals who do not comply with VAT regulations. These penalties can vary in severity, depending on the nature and extent of the non-compliance. They can range from fixed amounts to a percentage of the underpaid VAT.

- Interest Charges: Late payment or underpayment of VAT can result in interest charges. HMRC applies interest to the outstanding amount from the due date until the full payment is made. The longer the delay, the higher the interest charges can accumulate.

- VAT Inspections and Audits: Non-compliant businesses may be subject to VAT inspections and audits by HMRC. These examinations can be intrusive and time-consuming, potentially disrupting normal business operations.

- Criminal Prosecution: In cases of serious VAT fraud or deliberate non-compliance, criminal prosecution is possible. Convictions can result in significant fines, imprisonment, or both.

- Reputation Damage: Non-compliance can harm a business’s reputation. Customers and partners may view a company that consistently flouts tax laws as untrustworthy, potentially leading to a loss of business

Ensuring VAT Compliance

To avoid these consequences, businesses and individuals should:

- Maintain accurate records of all VAT transactions.

- File VAT returns on time, accurately reporting VAT collected and paid.

- Seek professional guidance or use VAT-compliant accounting software.

- Stay informed about changes in VAT regulations and adapt accordingly.

- Implement robust internal controls to prevent errors and fraud.

- Engage with HMRC when necessary and cooperate during audits.